Guest Lectures (BCom)

GST WORKSHOP

Date: 24th October 2024

Time: 09:00 am- 12 :30 pm

Title of the Event: “GST WORKSHOP”

Venue: CHANAKYA SEMINAR HALL

Target Audience: B.COM students

Organized by: Commerce Club

Faculty Coordinator: Suchitra Deviprasad

Student Coordinator: Ms Varshini G, Ms Aishwarya Madhusudhan

About the event:

In association with IQAC, Commerce Club conducted a seminar for B.COM students.

OBJECTIVE:

- To help the students build knowledge about taxation in India.

- To help the students understand the taxation reasons.

- To help the students realise the importance of GST being implemented in India.

- To brief the students on the role of GST and its implications.

In association with IQAC, the Commerce Club conducted a GST WORKSHOP on 24.10.2024. The seminar took place in the Chanakya Seminar Hall, and students from the 5th semester participated.

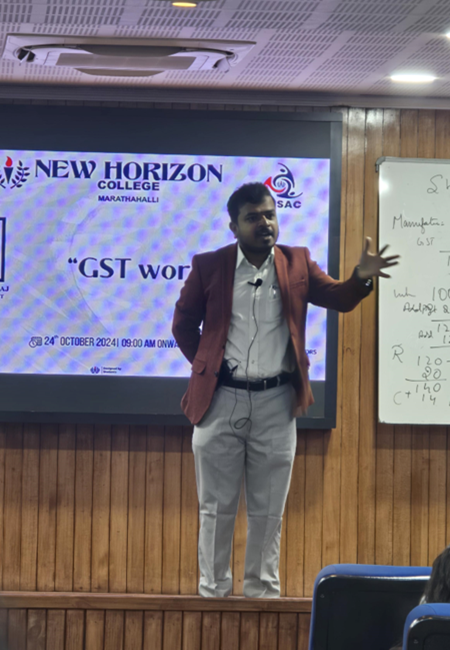

Mr Anil Bhardwaj, a Chartered Accountant, Senior Partner, and Founder Partner of Bharadwaaj and Hosmat Chartered Accountants conducted the GST workshop.

Mr Anil Bharadwaj has been a resource person, keynote speaker, and panellist at more than 35 national conferences conducted by various universities and colleges across Karnataka, delivering almost 100 seminars on GST to date.

He is also recognized as one of the few resource persons who can explain the Tax provision in Kannada, which has helped spread knowledge in rural areas. Mr. Anil Bharadwaj is one of the most preferred resource persons for ICAI on various topics, including programs on Investment awareness, wealth creation, and tax planning for Investors.

The workshop was knowledgeable. It was conducted for third-year students. Students were completely involved and interactive with the speaker. It was a three-hour workshop. The techniques or innovative work used by the speaker to reach out to the crowd or deliver the message to the students were entirely different but intellectual. The speaker also allowed students to grab the opportunity to receive small prizes from him, and at the same time, students initiated with their answers.

OUTCOME:

The students were able to develop their IQ knowledge. This helped them also to develop an understanding of the role played by GST in our economy.